The Human Cost of Media Mergers: who will buy Warner Bros. Discovery?

Who will buy Warner Bros. Discovery? Three industrial scenarios, impact on Italy and some practical advice on how to survive.

Three Scenarios to Understand the Future of TV, Streaming, and Media in Italy

in the current newsletter of AdvExpress a local adv magazine I released today a detailed article about industrial possible impact in Italy of WBD sales. See here

Here I will report in the english version a PREMIUM version of this column with a summary of it but enriched with the very important aspect of the matter that rarely is discussed publicly but it is the most impactful. PEOPLE.

let’s start. Stay with me till the end. It takes 4 minutes.

Warner Bros. Discovery (WBD) has become the center of one of the most relevant media consolidation stories of the decade.

This is not just another rumor cycle: WBD is the last true hybrid major operating across studio production, streaming, linear TV, cinema, and advertising.

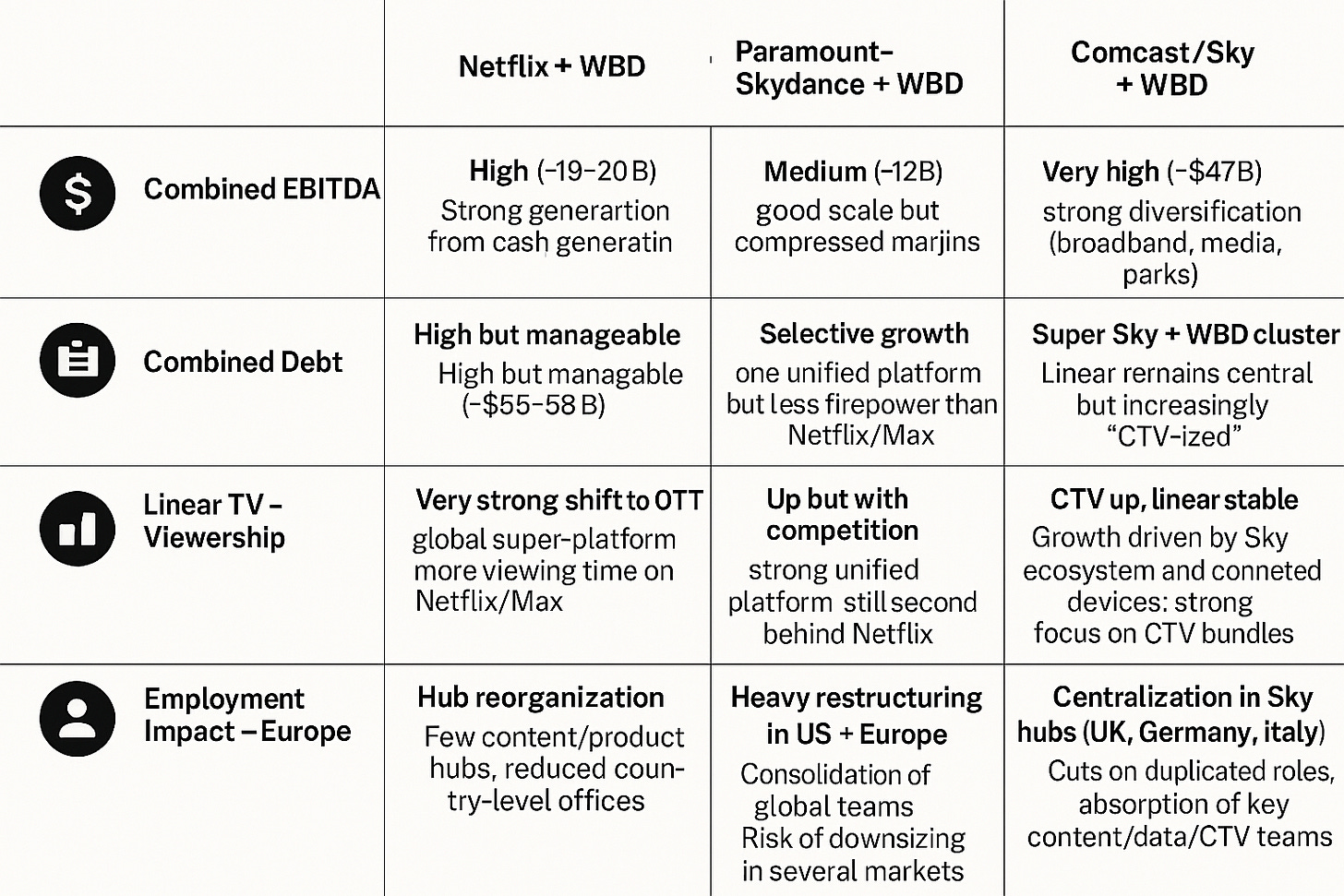

In this article, I examine three concrete acquisition scenarios:

Netflix + WBD

Paramount–Skydance + WBD

Comcast/Sky + WBD

Each scenario is analyzed through:

combined EBITDA

debt

linear TV audience share

ad revenue

employment impact in Europe, with a focus on Italy

At the end, I include a premium postface on the human cost of media mergers — something rarely discussed, but fundamental.

WBD: The Last Hybrid Major

2024 key numbers:

Revenue: ≈ $39.3B

Adjusted EBITDA: ≈ $9.0B

Gross Debt: ≈ $40B (≈ 4.4× EBITDA)

DTC subscribers: ≈ 128M

Italy: #1 theatrical distributor in 2023 (~€100M box office), 9–10% linear share

WBD is not a pure streamer nor a pure broadcaster.

Its value sits across the entire audiovisual chain.

Scenario 1 — Netflix + WBD

The streaming purist who doesn’t want linear TV on its balance sheet

Netflix 2024:

Revenue: ~$39B

Operating income: ~$10.4B

Total debt: ~$15–16B

Combined entity:

Revenue: ~$78.3B

EBITDA: ~$19–20B

Debt: ~$55–56B

Strategic logic

Netflix has repeatedly made clear it does not want traditional linear channels.

In this scenario:

Studio, IP, library, Max → kept

Linear channels (TNT, TBS, Discovery, Nove, Real Time…) → sold or shut down

Viewership impact

Netflix + Max would exceed 400 million OTT subscribers, creating a global super-platform.

In Europe, where linear TV is still strong, this would accelerate the shift toward streaming.

Advertising impact

The expansion of Netflix’s ad-tier + Max integration means:

more premium CTV inventory

higher CPMs

more data-driven global-first campaigns

Traditional TV, especially in Italy, would see increased pricing pressure.

Italy’s specific issue: who gets WBD’s 10% share?

Potential buyers:

Mediaset

Sky

financial aggregators

Employment impact

Netflix’s lean culture means:

high risk for linear TV staff

reduction of country-level structures

limited absorption of corporate and branded entertainment roles

Scenario 2 — Paramount–Skydance + WBD

A legacy-media patch requiring aggressive synergies

Paramount 2024:

Revenue: ~$29.2B

Debt: ~$15.1B

Combined entity:

Revenue: ~$68.5B

EBITDA: ~$12B

Debt: ~$55B + leverage for acquisition

Strategic logic

Two apps would consolidate:

Paramount+ + Max → one global platform

Pluto TV becomes the main FAST engine

A “generalist premium” OTT combining:

Star Trek

Yellowstone

DC

Harry Potter

HBO

Discovery unscripted

Linear TV

US: cuts, closures, brand consolidation

Europe/Italy: linear TV still performs → rationalization rather than shutdown

Advertising

A reasonably strong third pole across Europe, with bundled TV + OTT + FAST inventory.

Employment impact

Because EBITDA is weaker and debt is heavy:

15–20% workforce cuts across duplicated positions

Italy: revenue-facing roles protected; staff/central roles vulnerable

Scenario 3 — Comcast/Sky + WBD

Europe becomes the integration laboratory

Comcast 2024:

Revenue: ~$124B

Adjusted EBITDA: ~$38B

Debt: ~$99B

Combined entity:

Revenue: ~$163B

EBITDA: ~$47B

Debt: ~$135–140B

Strategic logic

Sky becomes Europe’s OS of video, a vertically integrated environment:

Pay-TV

Free-to-air channels (TV8, Cielo, WBD networks)

OTT layers: NOW, Peacock, Max

Advertising

Sky Media + WBD form one of the most powerful advertising clusters in Europe:

cross-screen planning

high-value premium audiences

large-scale CTV adoption

Employment impact

Comcast tends to centralize:

integration into UK/Germany hubs

consolidation of duplicated roles

absorption of data, content, and addressable TV talent

What This Means for Italy

Regardless of the buyer, some outcomes are already clear:

Linear TV is not dead, especially in Italy — but its future owners may be global tech-streamers, not domestic broadcasters.

The real battle is for reach + CTV + data + IP.

Brands must evolve from GRP-led thinking to screen-agnostic planning.

The real Italian question is:

Who will finance Italian content over the next decade, and with what approach?

This deal will influence the industrial, cultural, and economic shape of the sector.

⭐ [Premium] Postface — The Human Cost of Media Mergers

The real impact of these mergers? People.

Behind every optimistic press release and every promise of “synergies,” there is a silent shockwave when major groups consolidate:

the human fallout.

Peripheral markets like Italy experience the hardest blow.

Highly specialized professionals exit large organizations all at once, and the industry cannot absorb them.

Many don’t return.

And a “big employer” is no longer a guarantee of stability.

The harsh truth:

the worst consequence of mega-mergers is the systematic waste of talent.

I know this because I have lived it.

And here is the first lesson: your first reaction is almost never the right one.

Most people panic, withdraw, or hide inside their corporate network.

But unless you have a strong personal circle or you are a plug-n-play employee, your corporate network disappears in 48 hours.

No one is coming to save you.

This is why it is crucial to ask:

Who am I without the logo on my business card?

What do I really bring to the table?

Here are the five lessons I wish I had understood before being laid off:

1. Smell the air early.

Rumors say more than corporate announcements.

People protect themselves first. Find the truth quietly. No one is going to take care of you. Neither your boss, they start securing themselves first. And if you have doubts, there are no doubts. (Robert De Niro, Ronin cit)

2. Leave your comfort zone immediately.

Waiting is the most dangerous instinct. If you meet any challenge that scares you but may brings new competences, go for it. There is nothing more dangerous than jumping into a new merged company.

3. Build real relationships, not contacts.

Networks work only when you have built something meaningful with people. Experience of working together is the currency, Tipically C-level and senior people play an indoor match spending time in useless meetings and in corporate politics. This can kill your career. Find a project, take anything that can bring you on the field with real people.

4. Build yourself, publicly.

Your personal brand is more powerful than your employer’s.

Show how you think and what you can actually do. Your english shining and useless job description won’t rescue you. No one cares of you being overseeing P&L and contributing to this and that and VP of nonsense corporate nothing: all likes, “media and marketing top this and that” are only a commercial deal and vanity economy. They praise you until you can pay. When you loose this utility you are done. Start giving, show what you can really bring to the table, roll your sleeves. Unless you are belonging to a strict privileged inner circle or your boss get a top job and needs you, you have to count on your only forces.

5. Start before layoffs begin.

Preparation determines whether you drown or resurface. Do not wait the day in which you will be on that list. Tipycally it takes 2 years before the acquiring company lay off the other. Start immediately to nurture the network not by asking but by giving. Professionals call people they need to do something and they remember what you did for them. Build your brand with meaningful experience not with vanity or achievements. No one cares that you were top of 100 marketing person of the year of dragons or that you contributed to win that prize or that you owned 1000 slaves and a personal assistat was booking for you flight tickets.

I wish someone had told me this before my own layoff — sudden and brutal. Not everything can be predicted and managed unfortunately and the above pieces of advice are not a guarantee.

But I know this now:

Investing in your own identity is the most powerful form of job security you will ever have.

Thank you for reading, and for supporting this space.

More to come.